Create professional invoices in seconds, track payments in real time, and automate reminders all in one place

High-value add-ons that separate you from basic invoicing tools

Bill as your project moves forward Invoice clients based on completed milestones or project progress, ensuring steady cash flow throughout long-term projects.

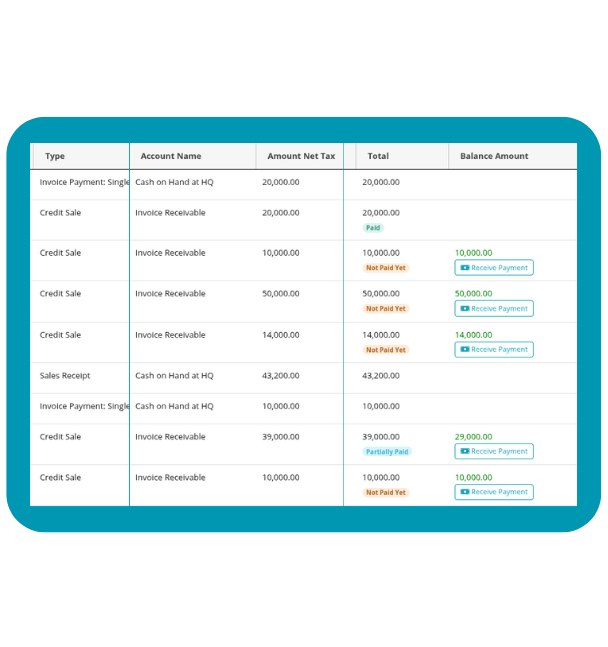

Flexible payments made simple Accept and manage payments across multiple invoices with full visibility and control.

Keep clients informed automatically Automated notifications ensure customers always know their invoice status, reducing delays and misunderstandings.

Never miss a payment deadline Smart reminders and escalation rules help you collect payments on time without manual follow-ups.

Get paid before the work begins Record and manage advance payments and automatically apply them to future invoices.

Handle adjustments professionally Issue credits for returns, discounts, or billing errors while keeping your accounts accurate.

Create professional invoices in seconds, track payments instantly, and automate reminders — all from one powerful platform. Stop chasing payments and start focusing on growing your business.

Save time and ensure consistency by automating recurring invoices for subscription-based services, rent, utilities, or regular client orders.

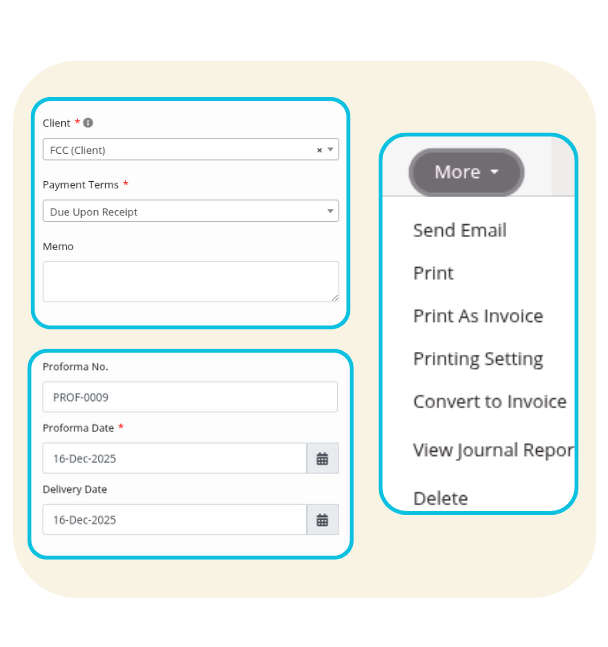

Provide potential clients with detailed estimates or quotations before finalizing sales. Proforma invoices help set expectations and increase transparency.

Offer clients the convenience of purchasing on credit while keeping your receivables organized. Manage loans, installments, and overdue payments efficiently.

<p>Yes! We’re ready to answer all your questions with email support or phone call through <strong> 0755 907 799</strong> </p>

<p>Put your wallet away, you won’t need to enter in any credit card ever, unless you want to subscribe in either of the packages and you will just be required to pay through different methods such as mobile payments. </p>

<p>NEXTACCOUNTING is 100% web-based, so you just need an internet connection and browser.</p>

<p>Completely safe. Our servers are protected and any connection between you and the server is protected by SSL encryption.</p>

<p>NO! You will need an internet connection to access NEXTACCOUNTING </p>

<p>Yes! NEXTACCOUNTING online is a full cloud solution that can be used on any compatible browser on any device with a web browser (computer device, and mobile device.)</p>

<ol><li><strong>Project management (Income & Expenditures)</strong></li><li><strong>Multiple Branches (Offices)</strong></li><li><strong>Banking</strong></li><li><strong>Taxes</strong></li><li><strong>HR (Employee & Payroll)</strong></li><li><strong>Inventory Management</strong></li><li><strong>Accounting</strong></li><li><strong>Expenses (Bills)</strong></li><li><strong>Invoicing (Sales)</strong></li><li><strong>Audit Logs</strong></li><li><strong>Report & Analytics</strong></li><li><strong>Notifications</strong></li></ol>

<ol><li>Always Ready for Tax time (TRA Returns)</li><li>Boost sales and productivity i.e. Fast Business Growth</li><li>Reduces Inventory Errors</li><li>Simplifies payroll</li><li>Optimize fraud</li><li>Promotes Data Accuracy</li><li>Instantly generate key financial reports</li><li>It Saves time and Resources</li></ol>

<ul><li>Secured</li><li>Cost Effective</li><li>Accuracy</li><li>Easy to Use & Well Organised</li></ul>

<p>NextAccounting is an all in one accounting package software which will help you manage Sales (Invoicing), Expenses (Bills), Inventory Management, HR (Employee & Payroll), Cash flow and Taxes. NextAccounting will help you handle the rest and let you focus on your big vision i.e. Business, Team and clients.</p>